Transport barometer: Sluggish economy meets summer slowdown

The number of freight offers in Europe increased by 57% on average in Q2 as compared to the previous quarter. The freight volume remains overall below the pevious year's figures and below pre-Corona virus levels.

The number of freight offers in Europe in the second quarter of 2023 © TIMOCOM

Erkrath, Germany, 14.07.2023 – The European transport market moved at a lower level in the first half of 2023 as compared to the previous year and is underperforming figures posted in the pre-Corona year 2019. After the last two atypical years, which remained affected by the pandemic and its recovery effects, road transport as a whole has quietened down significantly. In Q2 2023 there were 46.3% fewer freight offers on average in the spot market across Europe, as compared to the same quarter last year. Within Germany there were even 59% fewer offers on average. The European freight charge per kilometer was, on average, 14.1% lower in the second quarter as compared to the same quarter last year.

Following a weak start in the first quarter, an increase in transport demand emerged in the second quarter. Contrary to the sagging business climate forecast by the ifo index, April saw an increase of 40% more freight offers being placed across Europe and 61% more freights being placed in the spot market in Germany, as compared to March 2023. In May, another 18% more freight offers were added in Germany as compared to the previous month, while across Europe there was a plus of 8%. Overall, thanks to the strong start in Q2, there were 57% more freight offers in the TIMOCOM marketplace as compared to the previous quarter.

The clear increase in freight offers in the 2nd quarter is due, among other things, to seasonal business. "The months of April and May were the strongest months until now in terms of freight offers, thanks to the special challenges of the shortened holiday weeks this year", explains Gunnar Gburek, Head of Business Affairs at TIMOCOM.

Weakening routes due to declining exports

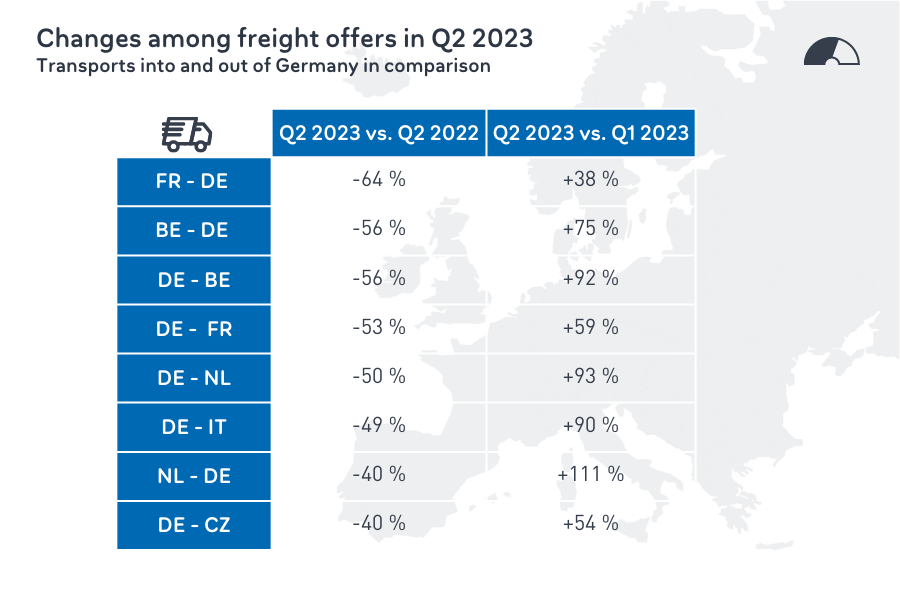

Overall, imports and exports in the Eurozone are declining, imports and exports in Germany have fallen according to the German Federal Office of Statistics. The economy in Europe is sluggish; this can be clearly seen in the TIMOCOM transport barometer. Large declines were measured once again in the Germany-France (DE-FR -53%) and France-Germany (FR-DE -64%) routes in comparison to the same quarter last year. From Belgium to Germany there were also 56% fewer offers. From the Netherlands there were 40% fewer freight offers with a destination in Germany (NL-DE -40%). There was also a decrease in transports from the Federal Republic of Germany towards Belgium, the Netherlands, Italy and the Czech Republic.

Indeed, the Kiel Institute for the World Economy (IfW Kiel) is assuming a minus of 0.3 percent as compared to the previous year, instead of the plus 0.5 percent that it had forecast early in the year. Nevertheless, it is expecting moderate growth by the German economy in the further course of the year, following the weak winter months. It is actually possible to note clear increases in freight offers over many country routes in Q2 as compared to Q1 2023, including from and to Belgium, from and to the Netherlands, and to Italy.

Uneven trend in the development of inland transportation

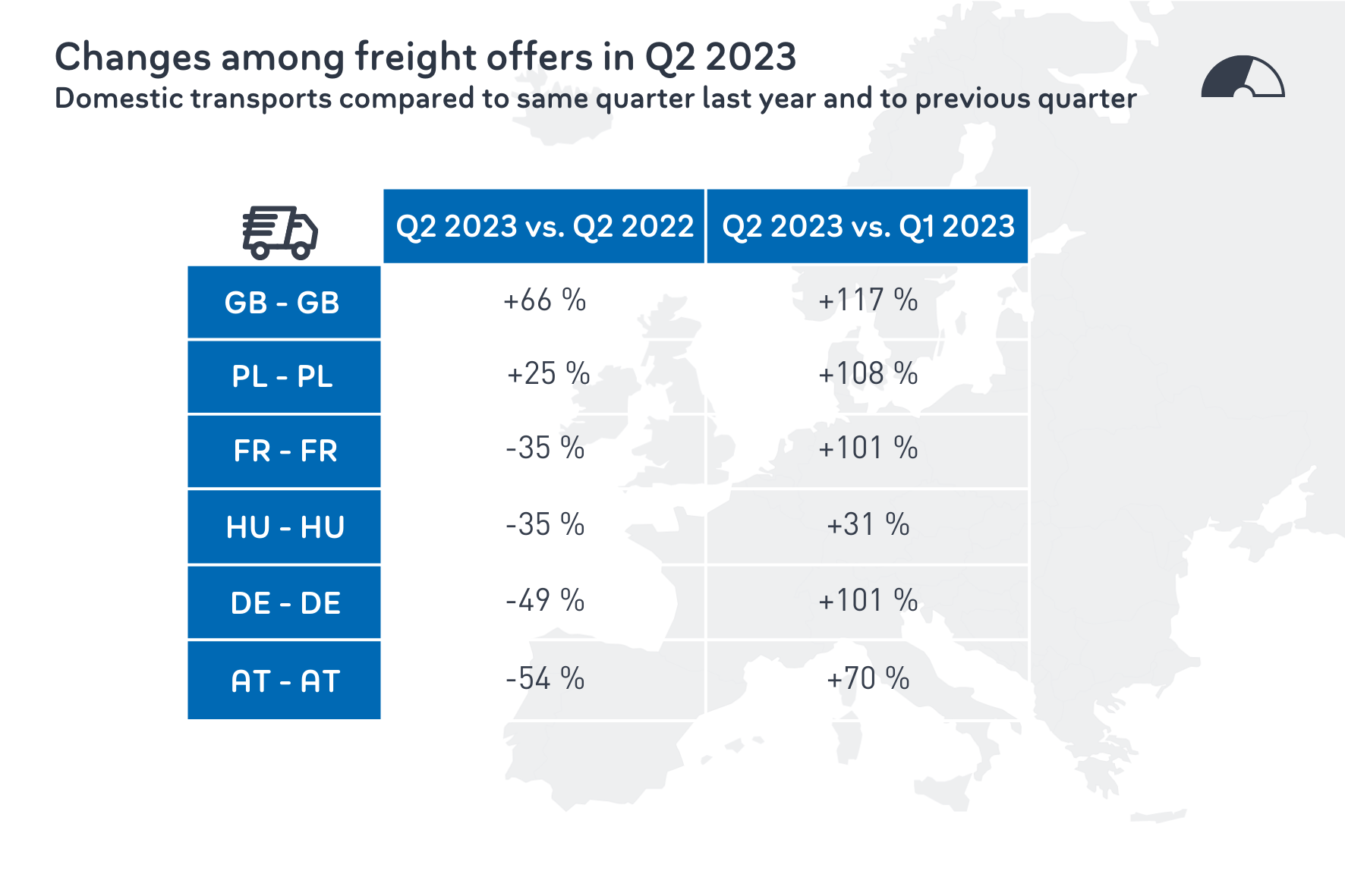

While Great Britain and Poland were able to significantly increase their demand for inland transportation, development was regressive in Germany, France, Austria and Hungary, among others, as compared to the second quarter of 2022. Clear growth in freight offers could be seen, however, as compared to the first quarter 2023. A reason for this: While France and Germany posted extraordinary growth in freight offers in the second quarter 2022 due to the recovery effects of the Coronavirus pandemic period, this growth was not as significant in Great Britain and Poland at the time. This is why they are able to achieve these increases of 66% and 25%, respectively, as compared to the same quarter last year . Along inland transportation routes in Austria (AT-AT -54%) and Germany (DE-DE -49%), as well as in France (FR-FR -35%) and Hungary (HU-HU -35%), the extraordinary figures of the previous year could not be achieved once again, despite the increases in Q2 2023 as compared to the first quarter.

Summer slowdown in sight: Downward trend since June

Since June, the downward trend in the number of freight offers due to the traditionally weak summer months, which are also combining with a slackening economy, can be recognised across Europe. In June, freight entries fell by 15% across Europe as compared to the previous month.

What is surprising here is that the vehicle space offers did not increase in this time period, but rather decreased by 10% as compared to the previous year's value, and by 29% as compared to the previous quarter. The sagging economy has an effect on the spot market on both sides, both on freight offers as well as on vehicle space offers. "Hauliers offered their services once again via classic distribution channels, or they made fewer capacities available on the market due to absent prospects of success", says Gunnar Gburek based on numerous conversations with freight forwarders. The participation of service providers in tenders has decreased in the second quarter as compared to Q1 2023: The higher demand for capacities in the spot market could explain why there are 45% fewer bids with an almost constant level of tenders for regular transport.

There is still hope that the economy gains traction in the second half of the year. The transport industry already has the experience to cope with challenging situations. "Heavy demands were placed on professional drivers and dispatchers in the past years, and they worked at full speed. Thus, they are able to dial things down during the few turbulent summer months", states Gunnar Gburek. "Starting in fall, at the latest, transport capacities are expected to be in higher demand and lorries to be at capacity utilisation once again."

About TIMOCOM

TIMOCOM GmbH is a mid-sized German FreightTech company, with more than 650 employees from over 40 countries worldwide and offices in Poland, the Czech Republic and Hungary. This IT and data specialist supports its customers in achieving their logistics goals with a marketplace for European road freight transport. More than 53,000 verified customers are connected to this marketplace, where up to 1 million international freight and vehicle space offers are entered every day. TIMOCOM is a trailblazer and pioneer, paving the way for the digitalised future of logistics.

Find out more about our leadership team, our company history, our milestones until now and our applications in the TIMOCOM press kit.