TIMOCOM transport barometer: Freight prices set to fall again in the coming weeks after rising ahead of Easter

Transport demand remained high in the first quarter of 2024. There were more than twice as many freight offers on the TIMOCOM Marketplace as there were in the same quarter of the previous year.

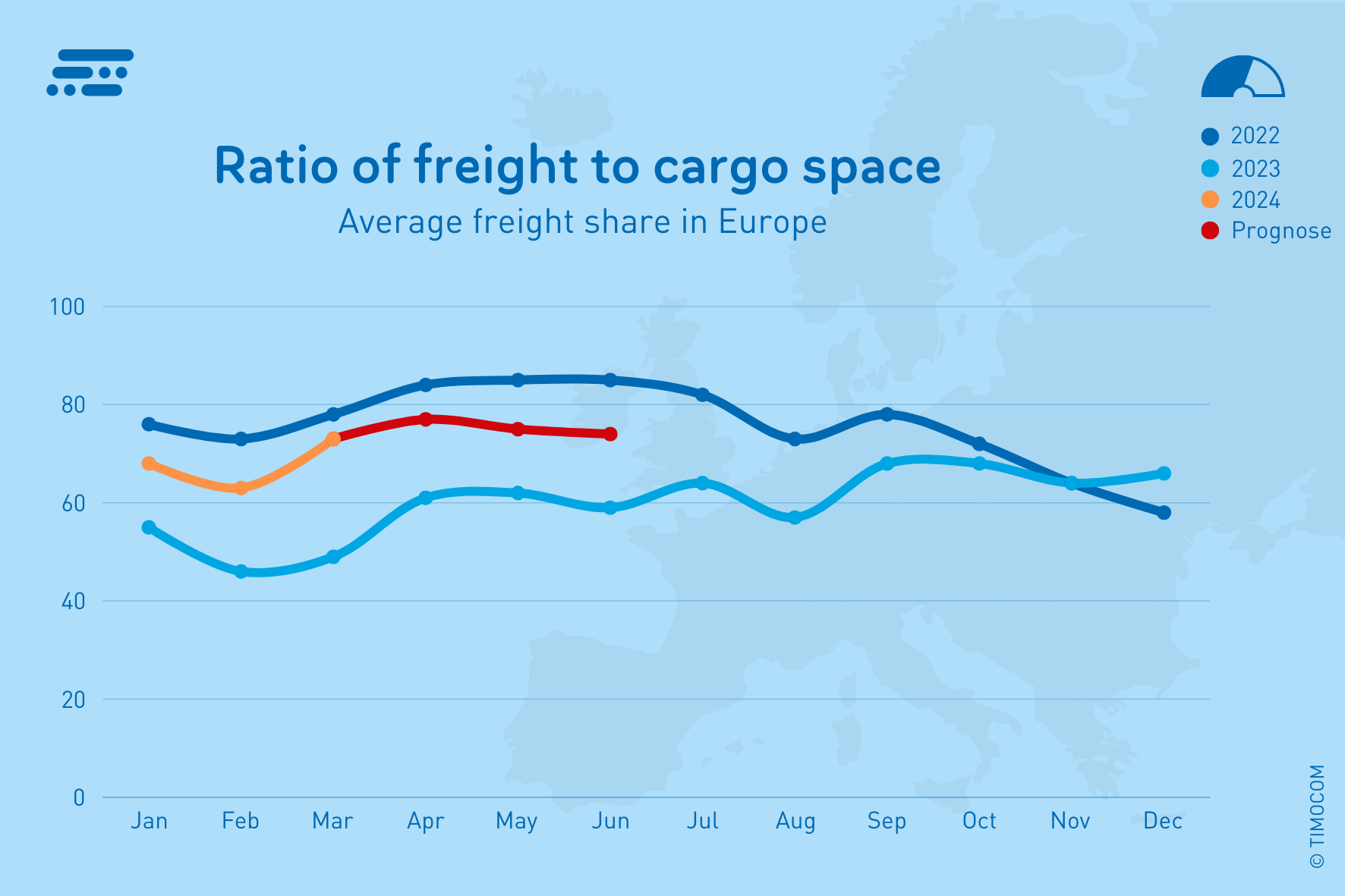

Contrary to the negative outlook at the beginning of the year, the transport market developed very positively in Q1. In absolute terms, freight volumes were significantly higher than in the previous quarter (+30%) and almost reached the level seen in 2022. Across Europe, more than twice as many freight offers were posted on TIMOCOM’s freight marketplace as in Q1 2023 (+106%). The number of offers and freight prices rose significantly compared to the previous year, especially before Easter.

Demand for transport capacity remained very high even in February, which is usually a weak month. The sharp slump in the transport market expected by many failed to materialise. This is firstly because the number of available vehicles has fallen, as many hauliers have taken some of their capacities out of service or have not added to them. As such, 28% fewer trucks were posted on the TIMOCOM Marketplace in Q1 2024 than in Q1 2023. Secondly, the economic downturn has not been as dramatic as had been feared at the start of the year. Compared to the previous quarter, which included the traditionally strong Christmas business, another 30% more road freight offers were generated before Easter.

Rise in freight prices before Easter

On average, freight offer prices in Europe were 6.2% higher than in the same quarter of the previous year. “In view of the increased toll charges as well as personnel and energy costs, this is a modest increase,” comments Gunnar Gburek, Head of Business Affairs at TIMOCOM, on the price development. The freight price increases are caused by seasonal factors due to the increased freight demand in the weeks leading up to Easter, as retailers in particular are expecting additional deliveries during this period. In some cases, the prices offered were up to 16% higher than in the previous year. “The price increase in March is expected to subside in the second quarter of 2024 due to tough price negotiations on the spot market, among other things, and freight prices will consequently fall again. Nevertheless, it can be assumed that the average price per kilometre will be higher than the prices offered in 2023,” says Gburek.

Sentiment among companies has improved

Transport offers in Germany also increased significantly in the first quarter of 2024. An increase of 102% compared to the same quarter in the previous year is a remarkable rise despite gloomy economic forecasts, although the same quarter in 2023 was a particularly weak one. The mood among companies in Germany has improved significantly. The figures published by the ifo Institute at the end of March can be seen as a trend reversal. The ifo Business Climate Index rose from 85.7 points in February to 87.8 points in March. Companies’ expectations are also less pessimistic than before. Respondents in the transport and logistics sector and the hospitality sector in particular are now more confident.

Economic recovery and high demand through to June

German foreign trade gained surprisingly strong momentum in the first quarter of this year. Exports rose at the fastest rate in three and a half years. This means that transport demand is also expected to remain high through to June. “The transport industry is dependent on economic developments,” says Gunnar Gburek, Head of Business Affairs at TIMOCOM. “The positive trend in the exchange of goods within Europe is reflected in the number of freight offers and will continue into the summer.” According to the forecast, the freight share in TIMOCOM’s transport barometer will average around 75% per month, with minor fluctuations. The economic recovery in many European countries is having a greater impact on this than lacking and discontinued transport capacities. The decline in inflation and falling energy prices are good prerequisites for continued positive development on all sides.

More information on transportation market trends and the transport barometer can be found here.