TIMOCOM Transport Barometer: Strong domestic markets and growing east-west traffic ensure stability

Despite seasonal decline and decreasing transports towards Scandinavia, Southeastern Europe, and Great Britain, transport demand remains above last year's level.

Annual overview of the freight share in Europe compared with previous years and a forecast for Q1 2026.

European road freight transport defied the economic slowdown and remained largely resilient at the end of 2025. Despite economic stagnation and seasonal declines, the market stayed freight-driven: TIMOCOM's transport barometer shows an average freight share of 75% for Q4 2025 – two percentage points higher than in Q4 2024. While freight volumes with Scandinavia, South East Europe and Great Britain fell significantly, strong domestic markets and growing east–west routes ensured stability

Increase in freight offers, but seasonal slowdown towards the end of the year

In the full year 2025, the total number of freight entries across Europe increased by 21% compared with the previous year. September was the strongest month of 2025, with more than 30 million freight offers. After the annual peak in Q3, volumes fell by 21% in Q4 – a typical seasonal effect. Compared with Q4 2024, freight offers were still 10% higher overall.“This clearly shows that the market remains freight-saturated. Demand for transport continues to significantly exceed the supply of available vehicles,” explains Gunnar Gburek, company spokesman and Head of Business Affairs at TIMOCOM.

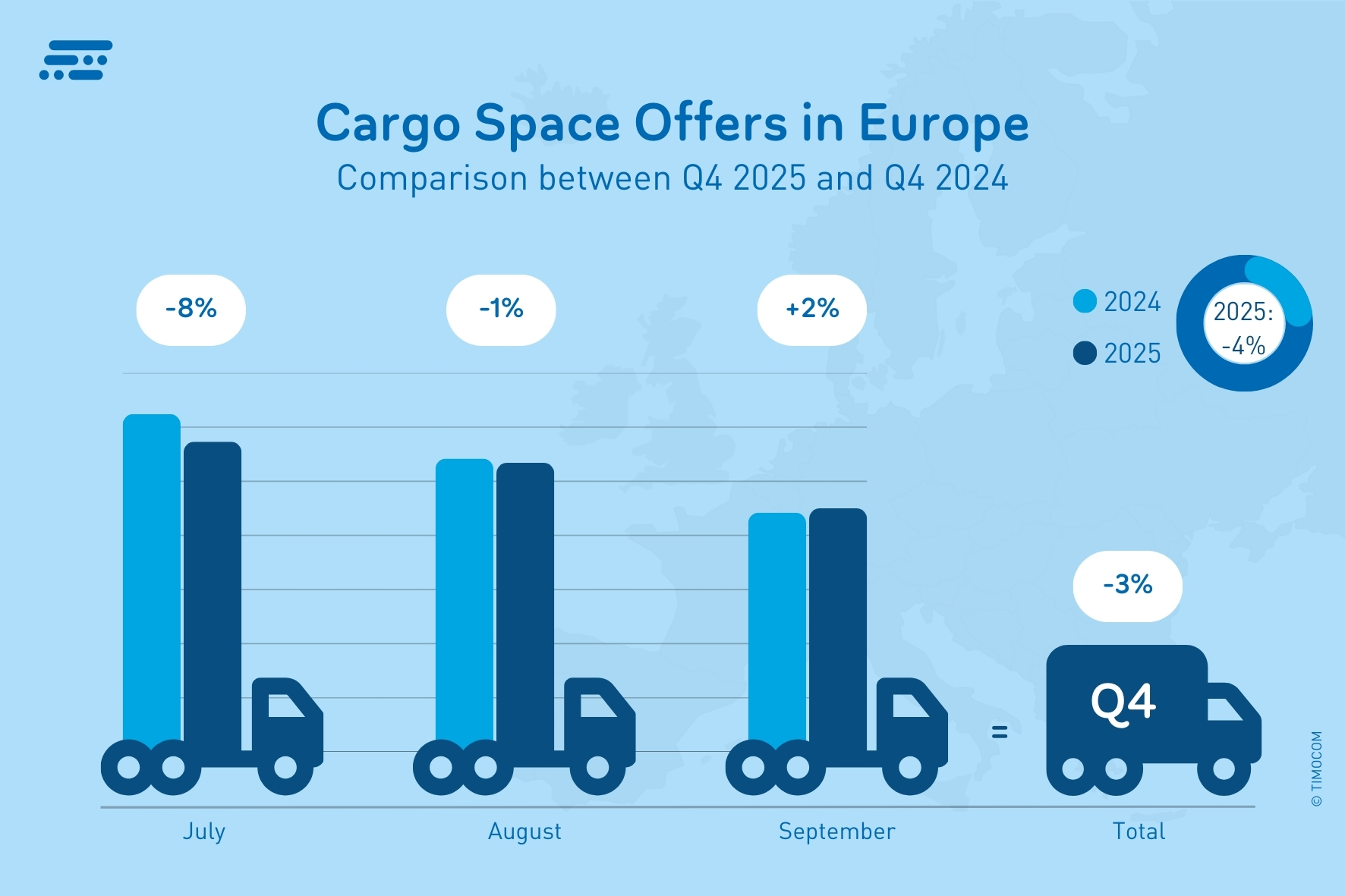

Vehicle space entries remained cautious and fell slightly by 3% in Q4. This suggests that little investment is currently being made in additional capacity. Instead, existing fleets appear to have been reduced further. This is supported by lower registration figures for heavy trucks in Europe, according to the European Automobile Manufacturers’ Association (ACEA): Q1–Q3 2025: -9.8%.

Cargo space offers in Europe continued to decline in the fourth quarter of 2025.

By year-end, many domestic markets showed a measurable year-on-year increase. France recorded a 34% rise in freight offers in Q4 2025, and Austria 22%, despite subdued economic growth overall. Poland saw the strongest increase in domestic traffic, with more than 250% more freight entries, supported by economic growth expected to be well above 3%.

In Germany, national freight offers increased by 6% in Q4 2025 compared with the previous year. Looking only at routes with freight offers from Germany to other European countries, volumes fell by around 4% in Q4. “Seasonal transports for consumer goods and foodstuffs in particular accounted for a large share towards the end of the year and contributed significantly to the stability of the transport sector. At the same time, declining German exports are also reflected in the freight exchange,” said Gunnar Gburek of TIMOCOM.

Divergent development on European trade routes

Transport supply on northern and south-eastern routes declined significantly in Q4. On the Sweden–Germany route, freight volumes fell by 78%. In the Balkans, the Germany–Romania (-43%), Germany–Hungary (-16%) and Poland–Croatia (-34%) routes also declined in Q4. Contributing factors include fewer foreign orders in vehicle assembly, a weaker construction market in South East Europe, and shifts in production and manufacturing activities.

Trade with Great Britain also remained sluggish in Q4. On the Germany–Great Britain (-40%), Italy–Great Britain (-55%) and France–Great Britain (-40%) routes, customs barriers, exchange-rate losses and weaker consumption continued to curb transport demand.

By contrast, freight volumes grew particularly strongly on routes such as Poland–Germany (+33%), Poland–France (+51%), France–Germany (+57%) and Spain–Germany (+72%). “The exceptional economic development in Poland is largely due to nearshoring effects, relocated production chains and strong export demand from the EU,” reports Gunnar Gburek. “Alongside positive developments in manufacturing in France and Spain, seasonally driven exports of vegetables and citrus fruits from the Iberian Peninsula are also likely to have contributed to the increase.”

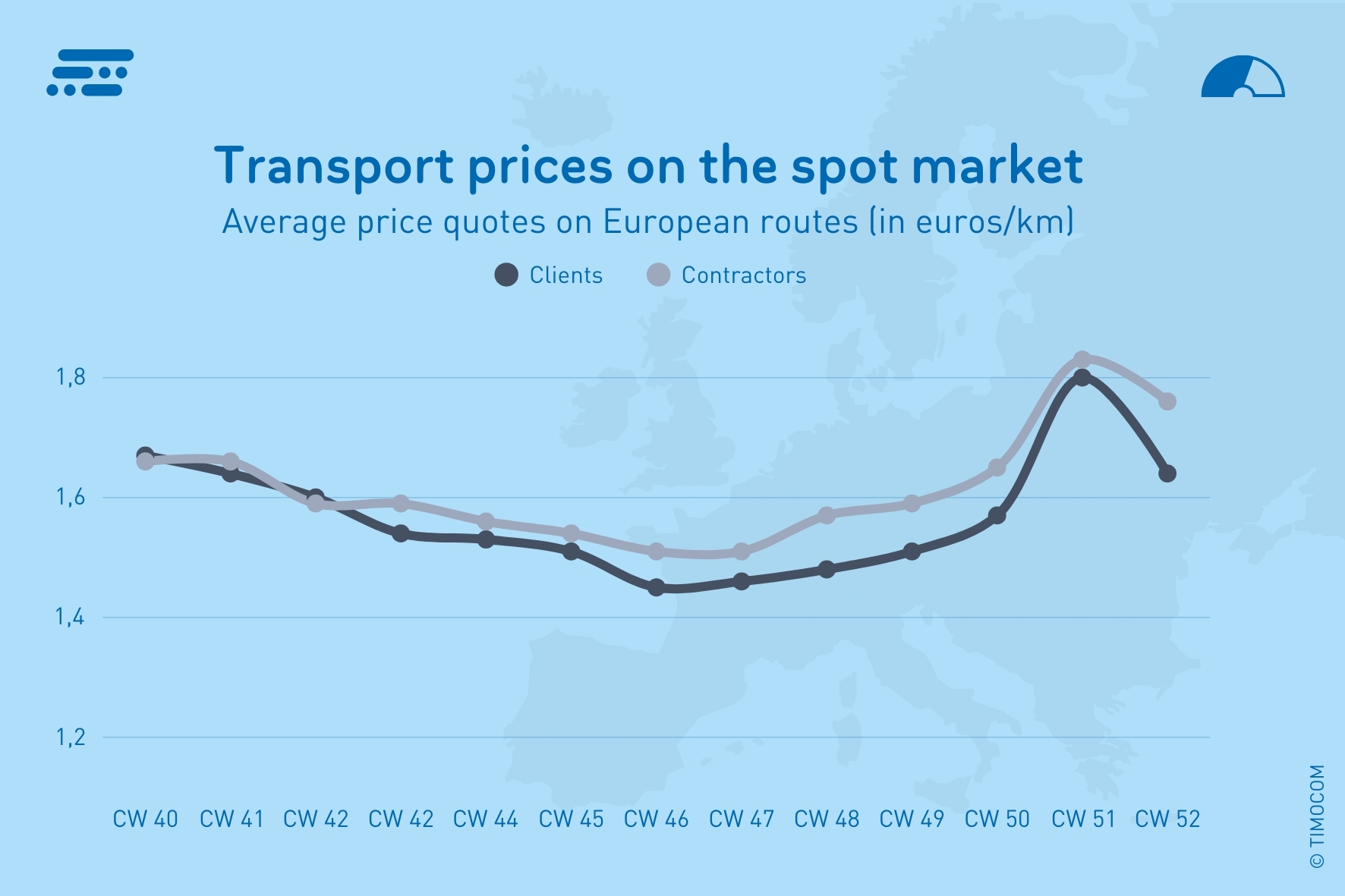

Average weekly price quotes on European routes in the fourth quarter of 2025.

Transport prices on a rollercoaster ride

Offered transport prices rose slightly in Q4 2025 across both international routes and domestic traffic in Germany:

- Europe-wide routes: Customers’ offer prices increased by an average of 2.7% year-on-year, ranging from €1.45/km to €1.80/km. Carriers’ quotes ranged from €1.51/km to €1.83/km (+3.7% compared with Q4 2024).

- Within Germany: Customers offered €1.58/km to €1.93/km (+3.1%), while service providers’ rates averaged €1.67/km to €2.22/km during peak-demand weeks (+4.8%).

The highest offer prices and quotes were recorded in the final two calendar weeks of the year.

Outlook: Seasonal dip in February – recovery likely from March

For Q1 2026, TIMOCOM expects the European transport market to remain broadly stable, with typical seasonal fluctuations. Compared with December, January is expected to see only a slight decline to around a 71% freight share. In February, during the usual seasonal low, this is forecast to fall to about 65%, before the spring upturn lifts the average freight share to 72% in March.

“This forecast is based on typical seasonal effects, expected stable energy prices, and the hope of a slight improvement in industrial demand and private consumption,” said Gunnar Gburek. “No significant cost increases are expected in the first quarter of 2026, so freight rates are likely to remain stable initially. However, this could change over the course of the year if demand for vehicle space picks up again.”

More information on transport market developments in Q4 2025 is available in the current TIMOCOM Transport Barometer Report .