TIMOCOM transport barometer: European road freight transport proves strong

Q3 2022 shows slight easing

The surplus of freight offers in Europe is slowly declining in Q3 2022. © TIMOCOM / free for editorial use

Overcapacity, price shock, driver shortage - European road freight transport has been facing massive challenges for months. But the latest figures from the TIMOCOM transport barometer for Q3 2022 show a slight easing for the first time.

The entire first half of 2022 was marked by a massive imbalance on the European transport market. However, despite all the negative signs, the situation began to ease in the third quarter. Although the ratio of freight offered to vehicle space offered was still above the 70:30 mark, the curve is levelling out to 2021 levels. The TIMOCOM transport barometer registered a total of 41.9 million freight offers in Q3 2022, up 10% on the same period last year.

“The significant freight surpluses of Q2 cannot be identified in Q3,” says Gunnar Gburek, Head of Business Affairs at TIMOCOM. “Instead, a seasonal cooling of the transport market set in, as we usually observe in the summer months.” This downturn is even more pronounced in 2022. Across Europe, 28% less freight was entered into the TIMOCOM Freight Exchange in Q3 than in Q2, and the change was even -34% for domestic German transports.

The reasons for this include the disruption of international supply chains as an economic after-effect of the COVID-19 pandemic and the war in Ukraine. As a direct consequence, the prices for fuel and vehicles have risen massively and due to high inflation, demand has decreased and inventories have increased. The German Manufacturing Purchasing Managers' Index of the Federal Association of Materials Management, Purchasing, and Logistics eV (BME) moved into negative territory for the first time in July and the economic outlook is pointing downwards.

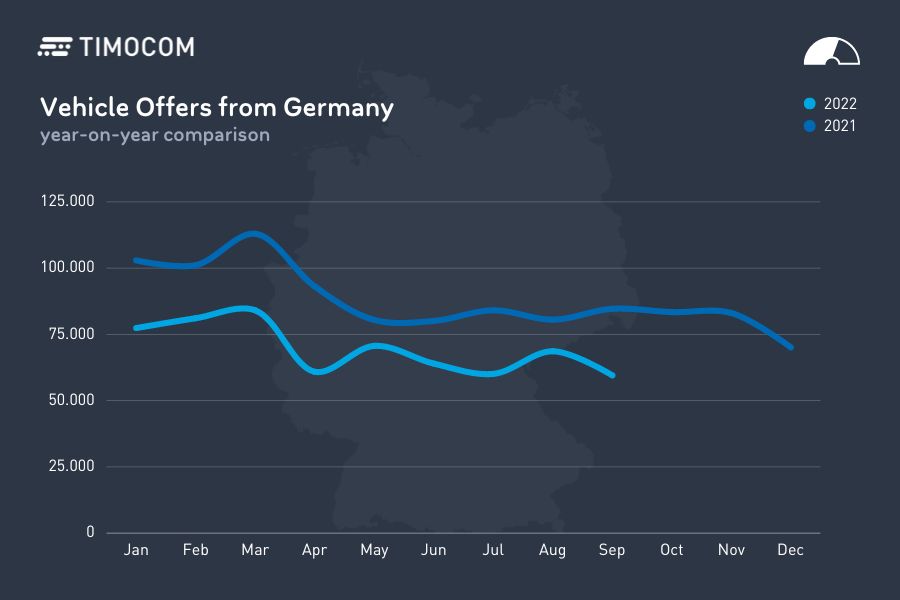

In Germany, 24% less capacity was posted on the TIMOCOM Freight Exchange in the first nine months of 2022 than in the same period 2021. © TIMOCOM / free for editorial use

Shortage of vehicle space - a European phenomenon

The biggest long-term challenge for the transport market is undoubtedly the driver shortage. The International Road Transport Union (IRU) estimates that there will be a shortage of 185,000 professional drivers in five years in Germany alone. This is triple the existing shortage, which was recently quantified scientifically for the first time: The German transport market is currently lacking 56,000 skilled workers according to a study on capacity bottlenecks in logistics, in which TIMOCOM is participating.

The effects can be seen directly in the entries of truck capacities in the TIMOCOM Freight and Cargo Exchange: Across Europe, offers of vehicle space in 2022 remained at the same level as the previous year. “However, if you take a closer look, you can see some worrying signs,” says Gunnar Gburek. “In Germany, the trend is clear: Much less vehicle space is being offered than in previous years.” On average, 24% less capacity was posted on the TIMOCOM Freight Exchange in the first nine months of the current year than in the previous year.

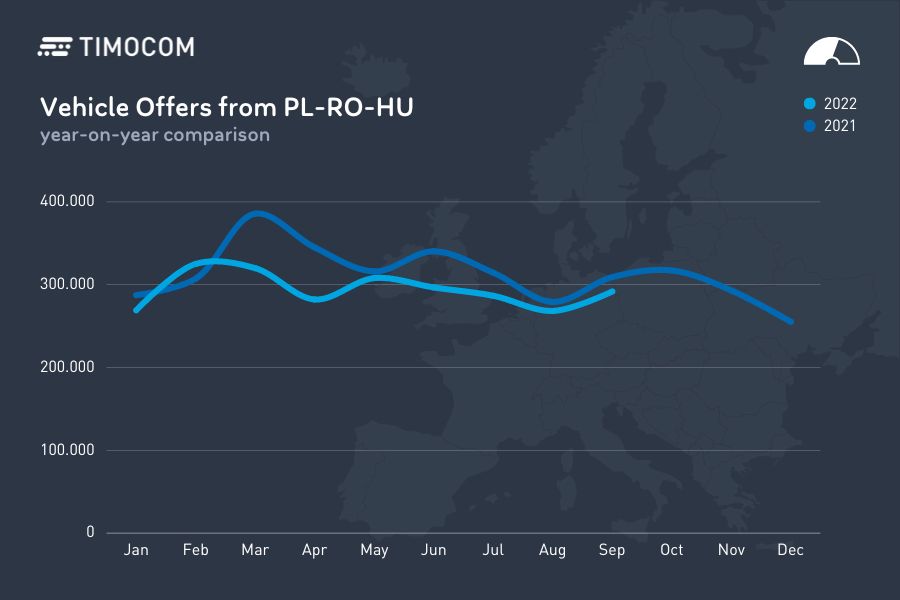

And there is also less and less capacity coming from the carrier countries Poland, Hungary and Romania. Since the beginning of the year, companies from these three countries have placed an average of 8% less vehicle space on the TIMOCOM Marketplace than in the same period in 2021. One reason for this, in addition to the sharply rising costs, is the lack of personnel. “Anyone who thinks there will be more qualified professionals coming in from abroad is mistaken,” says Gunnar Gburek and appeals: “Market participants must react urgently and reduce inefficiencies such as empty runs and waiting times at loading and unloading points.”

In 2022, there is less and less capacity coming from the carrier countries Poland, Hungary and Romania compared with 2021. © TIMOCOM / free for editorial use

Poland and Lithuania - hope for new vehicle space?

The shortage of vehicle space will increase given the figures so far and the upcoming Christmas season. In the coming quarter, Gburek expects more tight capacity and rising transport costs across Europe. Lithuania and Poland could be exceptions: Here, the supply of vehicle space or the number of large trucks is increasing. “Many Polish transport companies have so far relied on vans with a gross vehicle weight of 3.5 tonnes,” explains Denis Pasala, Director at the Poland location. “But with the mobility package and the change in the road haulage permit, keyword EU licence, this is becoming increasingly unattractive and many are now switching to larger trucks.”The Polish Automobile Association PZPM registered significantly more new truck registrations in Q3 2022, up 34% year-on-year in August and 17% in September. In contrast, the registration of vehicles up to 3.5t decreased.

Shoulder to shoulder – road freight transport as a reliable constant

Paradoxically, the extreme imbalance between capacity requests and offers in connection with the massive price increases for personnel, vehicles and fuel has given new strength to road freight transport. Whereas the lack of cooperation was criticised in previous years during the pandemic, the exceptional year of 2022 has made those involved in road freight transport rethink. To put it in perspective: Whether diesel, LNG or AdBlue, energy costs have risen so sharply since the outbreak of war in Ukraine that some fleet operators have already taken vehicles out of service. LNG trucks in particular have been taken out of service due to the high price of gas and are currently no longer available to the transport market. In view of the driver shortage, it is completely unclear whether and when these capacities will be returned to the market.

The clients' reactions to the impending economic situation for many transport service providers were prompt: Many settled for short-term price adjustments and agreed not only diesel but also energy floaters with their service providers. The unsatisfied demand for vehicle space gave the hauliers the necessary leeway to pass on their rapidly rising transport costs to their clients at shorter notice than would otherwise have been the case. “With our digital Marketplace, we were able to make a significant contribution to stabilising road freight transport in these difficult times,” says Gunnar Gburek. “Because the spot market has ensured the greatest possible flexibility and our large network has provided the necessary shoulder-to-shoulder contact between shippers and transport service providers.”

There is further relief in sight for the coming year: The looming recession in Germany will reduce the number of freight offers and thus reduce the pressure on road freight transport. Gunnar Gburek expects that the seasonal slump in demand for transport capacity in January 2023 will be greater than in previous years. Consequently, the shortage of capacity will decline and with it transport prices, which will at least stagnate at a high level.