TIMOCOM transport barometer: slight trend reversal apparent

Increasing demand for freight offers and limited capacities despite more vehicle space.

Grafik: Freight ratio trends in Europe © TIMOCOM

Erkrath, Germany, 13.04.2023 – the first few months of 2023 were marked by high energy prices, consumer reticence, full inventories and limited incoming orders. Economic predictions for the coming year are inconsistent and there is a great deal of uncertainty regarding how this will affect the transport industry.

When looking at the TIMOCOM transport barometer for the first quarter of 2023, however, there is a slight trend in evidence. After the first few months of this year saw significantly fewer freight offers than the previous quarter, the number of offers rose sharply in March across Europe, and were up by 42 percent, showing a slight reversal in trends in the decline in demand for vehicle space for the first time since autumn of 2022. Overall, however, there was a drop of 25 percent as compared to the previous quarter.

Grafik: Freight offers in Europe month by month © TIMOCOM

24 percent more vehicle space offers in first quarter

The number of offers for free vehicle space rose sharply in the first quarter of 2023. It was up by 16 percent as compared to the same quarter in the previous year, and up by 24 percent as compared to the fourth quarter of 2022. However, this is a result of the low availability of freight offers, not of any additional capacities on the market, which remain limited. This is of course due at least in part to the ongoing driver shortage and the state of the economy. It also confirms the tendency, seen in the previous quarter, of signing long-term contracts with service providers in order to secure available vehicle space.

Grafik: Vehicle offers in Europe increase as compared to the previous quarter © TIMOCOM

The interest in contracts has grown overall, partially because of the developments over the last few years, which have led many to fear that prices might rise sharply. Even though the demand is not very high, prices are booming, because costs are going up. As such, a successful strategy for the next few months might involve searching for available capacity on the spot market and then concluding a contract at the right moment,” according to Dr. Christian Kille, Director of Studies for Economics at the University of Applied Sciences Würzburg-Schweinfurt.

In addition, the average long-distance freight price on offer has risen by over 7 percent in Germany as compared to the previous year despite the high number of cargo space offers and the associated increase in competition. In Europe, prices have gone up by almost 3 percent. Costs have gone up so much that it is no longer realistic to expect prices to sink to a pre-pandemic level.

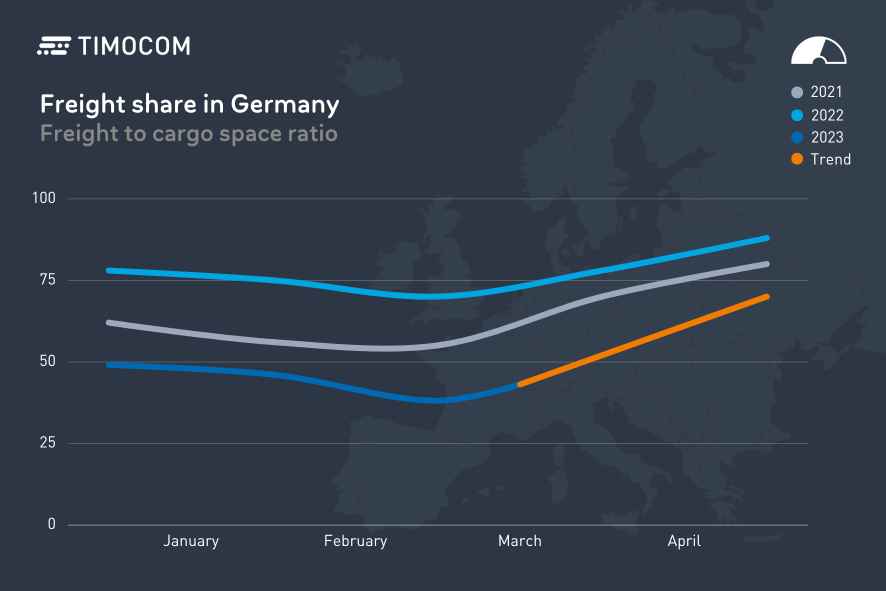

In terms of percentages, supply and demand were largely balanced in Europe in the first quarter of the year. On average, the freight to vehicle space ratio was around 59:41. This was also true for the German domestic market.

Grafik: Freight ratio in Germany © TIMOCOM

While it’s true that German industry is starting to see things more positively, the transport industry in particular is currently facing major challenges. Many transport customers have already begun adjusting their transport strategies to suit current conditions. This is reflected in the amount of freight available,” according to Gunnar Gburek, Head of Business Affairs at TIMOCOM.

Strikes in France have a major impact on surrounding countries

The nationwide strikes in France, which have been going on for some time now, have disrupted supply chains, leading to delays and supply bottlenecks. Cost pressures are also rising, as freight forwarding companies are forced to find alternative routes and means of transport. It is not just the strikes themselves: blocked roads and border crossings have badly affected the flow of goods between France and neighbouring countries, including Germany. Germany is one of France’s most important trading partners and are thus also feeling the effects of the strike. For example, transports from Germany (DE) to France (FR) are down by 55 percent, while transports from France (FR) to Germany (DE) are down 61 percent as compared to the previous year. And of course transports in France have also decreased, as was to be expected. But another country is reaping the benefits: transports from Italy (I) to France (FR) have risen by 11 percent as compared to the previous year.

Tension at Brenner Pass

The tension surrounding Brenner Pass continues to have a significant effect on road transport. Brenner Pass is one of the most important routes between Germany and Italy and a fulcrum for international goods transport. Trucks are being processed in blocks, forcing drivers to wait hours to continue their journey and causing significant delays. So it is no surprise that many hauliers are not particularly enthused about transporting goods to Italy right now. The high costs and intense time constraints are making it hard for many companies to make a profit. They are often forced to find alternative routes and means of transport in order to complete the transport orders. Of course, this also has an effect on freight and vehicle space offers. For example, tours from Austria (A) to Italy (I) dropped by 68 percent in the first quarter of the year.

In contrast, Italian exports seemed largely untouched by economic uncertainties, increasing significantly in the first quarter. Overall, however, the post-corona boom from 2022 has, as expected, slowed down. Despite that, and in contrast to European trends, Italy experienced a vehicle space surplus. Freight ratios dropped to below 40 percent as early as January, including on the domestic market. At the same time offers remained largely stable in February and March, with only a slight drop.

Polish freight offers follow trend

The first quarter of 2023 saw Poland record around 39 percent fewer freight offers than in the same quarter the previous year. In the same time period, retail profits in Poland also dropped in February by 5 percent as compared to the previous year, and around 3.6 percent as compared to the previous month. Industry production in Poland also dropped, sinking by 1.2 percent as compared to last year.

However, freight volumes in Poland then followed the European trend, increasing by 40 percent as compared to the previous month in March. Poland is an important transport hub in Europe, and developments remain dynamic.

Increase in vehicle space and freight offers expected

Considering current transport market developments, a significant rise in the number of freight and vehicle space offers can be expected in the holiday period, as was also seen last year. “This trend will continue until the end of May, before starting to drop once again when summer holidays begin in North Rhine-Westphalia at the end of June. What the rest of the year will look like, and therefore what developments we will see after that, depends heavily on economic trends in 2023,” said Gunnar Gburek, Head of Business Affairs at TIMOCOM.

TIMOCOM’s market experts publish up-to-date information on the transport market regularly on LinkedIn, in our transport barometer news segment. The FreightTech company TIMOCOM has been using the transport barometer since 2009 to analyse the development of transport offers and demand across 46 European countries. More than 154,000 users generate up to one million international freight and vehicle space offers daily on the road freight marketplace, which helps over 53,000 TIMOCOM customers to digitise and optimise their logistical processes.

About TIMOCOM

TIMOCOM GmbH is a mid-sized German FreightTech company, with more than 650 employees from over 40 countries and offices in Poland, the Czech Republic and Hungary. The IT and data specialist supports its customers in achieving their logistics goals with a marketplace for European road freight transport. More than 53,000 verified customers are connected to this marketplace, where they upload up to 1 million international freight and vehicle space offers every day. TIMOCOM is a trailblazer and pioneer, paving the way for the digitalised future of logistics.

Find out more about our leadership team, our company history, our milestones up to now and our applications in the TIMOCOM press kit.