TIMOCOM transport barometer: Europe at two speeds

Overall, there was an increase of freight offers in Europe of 12 percent as compared to the previous year. Demand for transport dropped at different rates in different locations.

TIMOCOM’s transport barometer exhibits a major decrease in freight offers for the final quarter of 2022, and thus a downwards trend in the demand for vehicle space. Throughout Europe, the number of offers added to TIMOCOM’s freight exchange declined by 36 percent as compared to the third quarter. Considering the significant freight surpluses during the first half of the year, the fourth quarter therefore marks a turning point for the European transport market. Germany appears to be following suit, with 39 percent fewer freight offers than the previous quarter. Freight offers began stagnating in Germany as early as June, but the trend only hit the European average in September.

Transport capacities secured early

The strongest drop was in December. In Germany, the number of available offers dropped by 55 percent as compared to the previous year. In Europe as a whole, there were 48 percent fewer freight offers as compared to December 2021. Overall, however, the number of freight offers placed on the TIMOCOM Marketplace throughout all of Europe was 12 percent higher in 2022 than the same number in 2021. Within Germany, however, there was only a 2.5 percent increase in freight as compared to the previous year.

Freight offers declined at different rates

The seasonal peak and the resulting decline in freight offers is nothing new. But what caused demand to decline at different rates towards the end of the year?

“Developments in road transportation this year were marked by driver shortages, as well as capacity and delivery bottlenecks. And then on top of that you have the drastic rise in inflation and the threat of a recession. These factors caused many transport customers to rethink their strategies,” according to Gunnar Gburek, Head of Business Affairs at TIMOCOM.

“Many companies secured transport capacity in advance, making sure they had guaranteed service for the seasonal peak. That in turn reduced the number of freight offers being placed on the Marketplace before Christmas, so there were fewer offers than in the previous year. Plus, this year Christmas fell on a weekend, which meant that there was greater available capacity in the week before the holiday, so there was not as much demand between Christmas and the New Year. The majority of foreseeable shipments had already been planned and assigned in November. And so there was no need to search for transport for them at short notice,” said Gunnar Gburek, interpreting the data.

“There is also a growing trend towards signing long-term contracts with service providers,” the company spokesman continued. “Demand will continue to drop in the first quarter of 2023, leading to an easing of transport prices. Over the long term, however, the price for road transport will end up being higher than it was in 2021, thanks to tolls, diesel surcharges and increasing personnel costs.”

Fewer transports between Germany and France

The biggest decline during the fourth quarter was seen in transports from Belgium (BE) to Germany (DE) and between France (FR) and Germany. France and Germany engage in very significant trade with one another; each country is one of the other’s most important trading partners within Europe. And foreign trade between them remained stable until October, despite both the energy crisis and inflation. However, according to the Federal Statistical Office of Germany, demand from abroad dropped significantly in November. EU countries ordered 10.3 percent and third-party countries ordered 6.8 percent fewer goods from Germany. Demand within the country sank by 1.1 percent.

In contrast, freight from Spain (ES) travelling to France rose in comparison with the fourth quarter of the previous year. The number of freight offers placed on the TIMOCOM Marketplace rose in October by 15 percent and in November by 22 percent. In December 2022, the amount of freight on this route reached the same level seen in 2021.

Freight offers in Poland remain stable

Freight offers in Poland are bucking the European trend slightly. In the fourth quarter, 6 percent more freight offers were recorded for Poland than were recorded in the previous year. The freight volume in the fourth quarter dropped only a little, by 7 percent as compared to the previous quarter, but remained high as compared to changes within other European countries.

International trade in Eastern Europe increased. For example, the amount of freight travelling from Poland to Romania rose significantly in the fourth quarter as compared to the previous year. In October, there was an increase of 89 percent for freight offers from Poland to Romania on the TIMOCOM Marketplace. In November, there were 7 percent more freight offers than in the previous year, however in December there was a clear drop in the number of offers, by 42 percent.

Vehicle space offers increased only slightly as compared to the previous year

There was an increase of 8 percent in available vehicle space offers as compared to Q4 2021. The vehicle space offers entered into the TIMOCOM freight exchange only experienced mild seasonal fluctuations over 2022, especially when compared to freight offers. “There was a decline in freight offers, but the number of vehicle space offers barely changed when compared to the previous year,” said Gunnar Gburek, analysing the developments. After experiencing an increase of 16 percent in the first quarter, the number of vehicle space offers fell by 8 percent in the second quarter when compared to Q1. In the third quarter, the number rose slightly by 2 percent, in the fourth quarter the available vehicle space did not change, on average, as compared to the previous quarter. Only in December was there a reduction in the number of trucks found in the freight exchange.

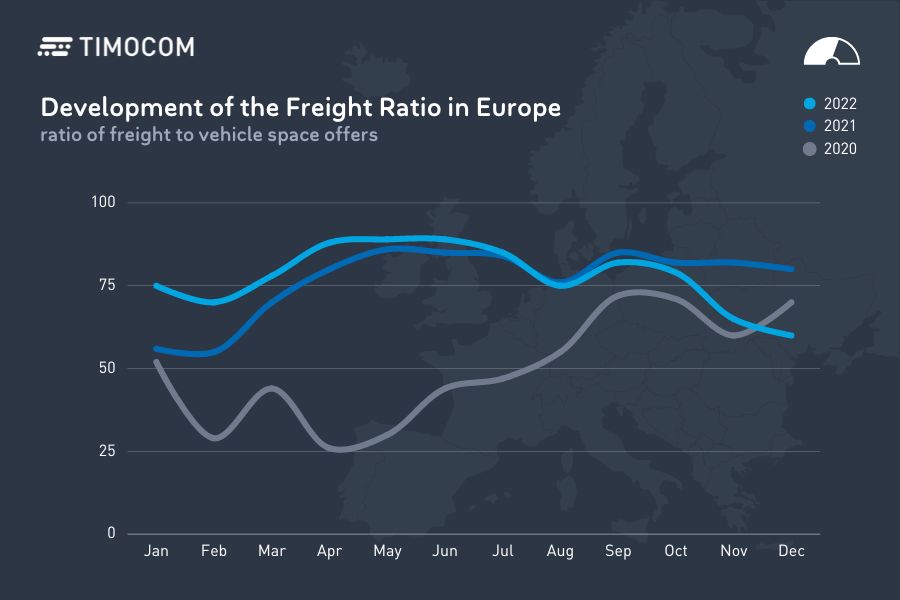

Freight to vehicle space ratio once again seasonal

The amount of freight offers compared to vehicle space offers was, in 2022, well above that recorded in 2020 (which was of course an unprecedented year), and did not drop below the final annual value from that year until the end of the year, due to the impact of the recession. The first few days of the new year have confirmed the trend that began in December of 2022. “It will be interesting to see what happens in the next busy season. We traditionally see an increase in freight offers before Easter. It’s likely that the ratio of freight to vehicle space will remain much more dependent on seasonal factors than it was before the pandemic,” Gunnar Gburek predicts.

According to the ifo Institute, Germany’s export expectations increased from 0.9 points in November to 1.6 points in December. Further developments will depend on the global economy. However, experts at the German Chamber of Commerce and Industry predict that exports will drop further in 2023, as reported by German magazine Handelsblatt. And it’s not just Germany purchasing fewer goods from abroad. Domestic freight amounts could increase proportionally in 2023, exacerbating the country’s driver shortage.

Digital tools and online marketplaces can help the logistics industry to improve planning and react to market changes flexibly and with an eye to long term sustainability.