TIMOCOM transport barometer: imbalance on Europe’s transport market

The demand for vehicle space continued to rise during the second quarter, while the total number of available trucks sank. Cross-border transports using smaller vehicles have also dropped dramatically since the introduction of the EU’s Mobility Package.

The European economy is in trouble, with the cost of energy, materials and personnel on the rise. The effect on road transport: transport service providers are reducing transport capacities, which were already at a premium. This in turn is exacerbating the imbalance on the market, as shown by the TIMOCOM transport barometer.

Transport bottlenecks fuel price spiral in Europe

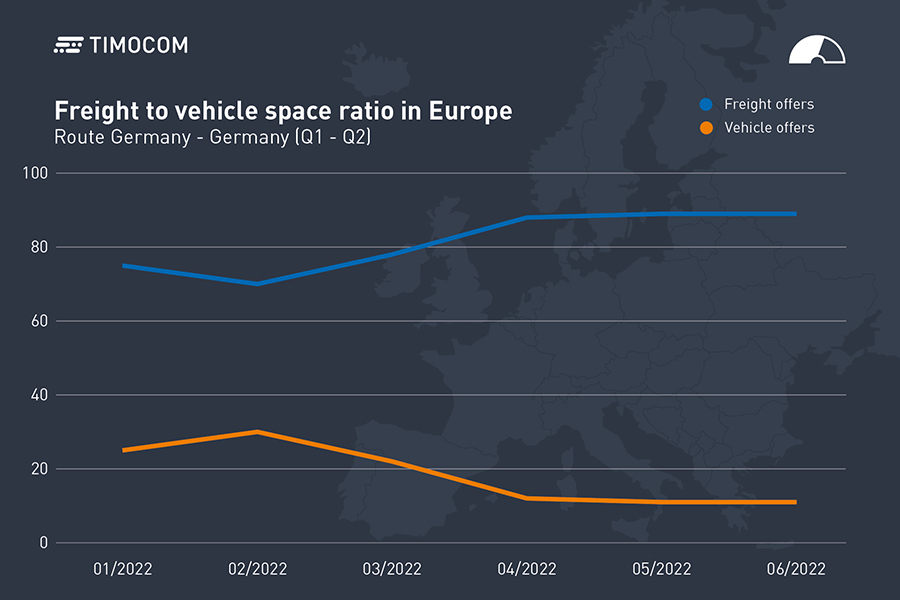

Despite continued delivery bottlenecks, raw materials shortages and difficulty receiving parts from suppliers, the demand for road transport remains high. But while demand continues to rise, the driver shortage and transport bottlenecks are fuelling a price spiral. The ratio of freight offers to vehicle space offers in Europe is badly mismatched, as shown by developments over the second quarter. In June, the ratio of freight to vehicle space in Europe was, on average, 85:15.

In Germany it was even higher, with an average of 89:11. The numbers for Germany indicate that during Q2, vehicle space was in particularly high demand in April and May, with lots of freight offers being entered into TIMOCOM’s freight exchange. The number of freight offers in April rose by 26 percent as compared to March 2022. In June, demand dipped slightly, by 8 percent as compared to the previous month, but was still 14 percent higher than the same month last year. In total, there were 63 percent more freight offers within Germany than there were in the first quarter of the year.

Transport capacity reduced, vehicle space at a premium

Rising prices for commodities and energy, combined with the driver shortage, have lead to many carriers and freight forwarders reducing capacities or prevented them from reactivating vehicles that are currently not in use. The total number of available trucks in the TIMOCOM freight exchange dropped by 19 percent in April. Over the course of the entire quarter, the amount of available vehicle space dropped by 7 percent as compared to the first quarter of the year. This represents a drop of 10 percent as compared to the same quarter in the previous year.

“It’s a service provider’s market right now,” according to Gunnar Gburek, Head of Business Affairs at TIMOCOM. “Finding vehicle space at short notice on the spot market is more important than ever, despite the high costs. Everyone is talking about the price, but we are seeing that finding available transport is currently more important than an inexpensive offer.”

The solution proposed by the EU Commission at the end of June could reduce tensions on the market. The proposal would make it easier for professional Ukrainian drivers to work in the EU. It would allow Ukrainian refugees who used to work as truck drivers to drive within the EU using their Ukrainian driver’s license for the duration of their protected status. In addition, it would mean that professional driver qualifications from Ukraine would be recognised across the EU.

Mobility Package I – is it the cause of the drop in cross-border transports?

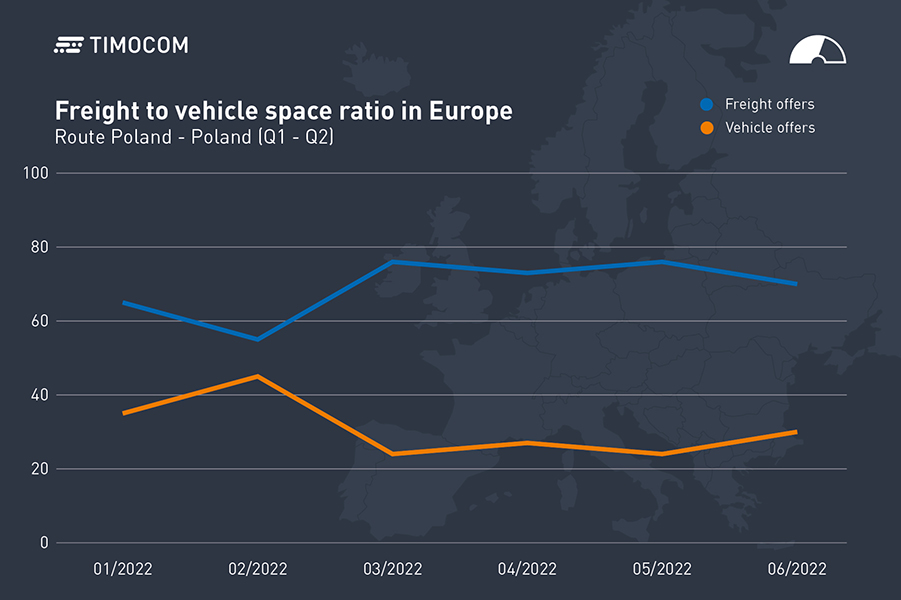

In Poland, the barometer has recorded some initial increases in capacity after a long dry spell: the demand for new trucks is growing. According to industry media within Poland, 70 percent of transport companies in the country plan to purchase new vehicles despite the increased costs. The problem here is the availability of new vehicles: freight forwarders have to wait several months or even a year for vehicles to be delivered.

The Mobility Package I is now in effect, meaning many carriers that have not yet applied for or received an EU license for vehicles up to 3.5 tonnes can, as of the 21st of May, no longer carry out international transports within the European Union. The result: the number of international transports in vehicles up to 3.5 tonnes travelling to and from Poland dropped by 38 percent as compared to the previous month. The freight offers in PL in the second quarter, on the other hand, rose by a total of 4 percent. One reason for this is the growth of eCommerce, including the fact that some Ukrainian companies moved to Poland after the war began.

This also explains why, in June of 2022, the transport barometer showed an average freight to vehicle ratio of 70:30 for the domestic Polish market. “In all likelihood we will have to wait some time before we see an end to the imbalances on the transport market,” predicts Gunnar Gburek.

Demand for storage space is growing

The current situation on the logistics market has jump-started demand for warehouse space in Poland, among other things because wheat being transported out of Ukraine is now being stored there, taking up previously free space. Hundreds of transports caused short-term chaos on the border between the two countries. This was noticeable in the TIMOCOM System as a short spike in demand on the Ukraine-Poland route at the end of May and beginning of June.

The amount of empty warehouse space sank in the first quarter of 2022 from 3.9 percent down to 3.3 percent. This trend has continued during the current quarter, and warehouse rental prices are rising.

The FreightTech company TIMOCOM has been using the transport barometer since 2009 to analyse the development of transport offers and demand across 46 European countries. More than 147,000 users generate up to one million international freight and vehicle space offers daily in the Smart Logistics System. The system helps over 50,000 TIMOCOM customers to digitise and optimise their logistical processes.