TIMOCOM transport barometer: freight offers in Europe exceed figures before the coronavirus pandemic

Second quarter of 2021 shows continued growth: once again, freight volumes exceed pre-crisis year 2019 – eased restrictions and production recovery are having an impact on the transport market in Europe

The second quarter of 2021 confirms the upward trend in road transport. The TIMOCOM transport barometer shows an overall steady increase in freight offers in the Smart Logistics System. A look at the second quarter's figures in 2021 shows: freight offers have more than tripled compared to the second quarter of 2020 and even exceed the values from the same period in 2019.

Increase in freight offers also in the second quarter

The first quarter's trend continued into the second quarter of 2021: the year had already got off to a good start in the first quarter with 58 percent growth in freight offers compared to the same quarter in 2020. With a further 51 percent increase in freight offers compared to the first quarter of 2021, new record figures were recorded in TIMOCOM's freight exchange in the second quarter. Compared to the weak second quarter in the coronavirus year 2020, this represents an increase of 251 percent. When compared to 2019, the year before the pandemic broke out, freight offers have even doubled.

The first quarter of 2021 ended in March with an increase of approximately 6 million more freight offers than in the same month of 2020. A significant increase continued in the second quarter: since April, more than three times as many freight offers have been entered in the Smart Logistics System. Among other factors, this is also due to the opening of retail stores and the overall economic development in Europe after the last wave of coronavirus subsided. In fact, the manufacturing industry is largely running at full capacity again. The economic recovery is also reflected in the shortage of vehicle space across Europe.

After an all-time high, a small summer low in the European market

The development in figures: April 2021 increased moderately by 2 per cent compared to the good month of March. In May, freight offers rose again considerably by 18 percent. "The aftermath of the Suez Canal incident played a role here, in addition to the relaxation of the coronavirus measures. Many goods had to be transported from ports in the weeks that followed," explains Gunnar Gburek, Company Spokesman at TIMOCOM. "In addition, eCommerce continues to grow. The seasonal decrease of 5 percent in June compared to the previous month did not dampen the trend."

Compared to 2020, which was characterised by restrictions due to the coronavirus, the quarter's individual months in 2021 recorded new highs: 334 percent in April, 345 percent in May and 152 percent in June.

More freight less vehicles

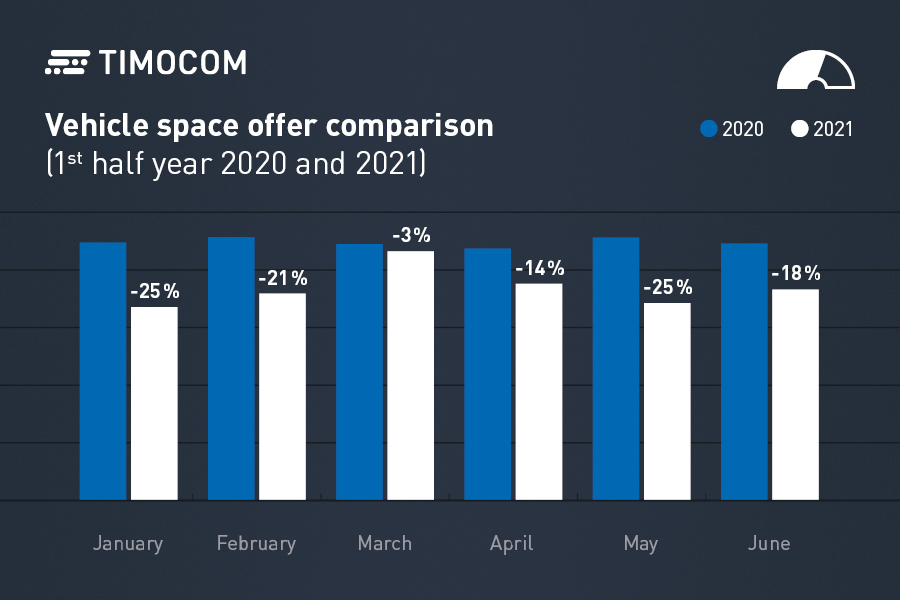

The sharp decrease in vehicle space offers continues to be evident. In some instances, decreases of up to -25 percent have been recorded compared to the previous year. However, this negative trend is a consequence of the high freight offer. After all, the potential to fully utilise the available vehicle space remains very high. Thus, the need to actively offer vehicle space is stagnating due to the abundance of offers. This enormous increase in freight offers is also evident when analysing individual countries.

Pre-crisis level exceeded in many markets

In Germany, 69 percent more freight was recorded in domestic transport in the second quarter than in the previous quarter of 2021. The slight decline of 4 percent in the first quarter of 2021 compared to the freight peak at the end of 2020 could consequently be more than made up for. The monthly development of domestic transport in the second quarter of 2021 in Germany: in April +2 percent, May +17 percent and June -5 percent. In addition to the overall economic trend, this development is also due to the cargo surplus caused by delayed container ships.

After a 15 percent decrease in 2020, the Dutch market recorded an average increase of 6 percent in Q1 2021. A growth rate of about 1.5 percent is expected here in 2021 for freight transport. Concerning the transport demand in road transport, the growth rates encourage optimism that this estimate will be exceeded. Information on the following country routes, for example, are an indication of this: the number of freight offers with loading location in the Netherlands and destination in Germany increased by 454 percent in the second quarter compared to 2020.

The Polish market is also continuing to show signs of recovery, even if the recovery after the coronavirus restrictions is somewhat slower compared to the European market as a whole. Even though the increase in the second quarter of 2021 was lower than that of freight offers in Germany, an overall increase of 183 percent compared to the same quarter of the previous year was recorded. Following an already buoyant first quarter of 2021 (+30%), freight volumes within Poland increased by 15 percent in the second quarter compared to the first quarter of 2021. The monthly development in detail: the strong March trend continued in Poland, although there was initially a 25% drop in April 2021 compared to the previous month. In May and June, the previous months were again surpassed: up by nine percent and up by 16 percent.

France records highest increase in domestic freight

Freight offers with loading location and destination in France have shown the largest increase in domestic transport in the second quarter of 2021 compared to the same period last year: an increase of 492 percent in April, 283 percent in May and another 93 percent in June. The market maintained the high level of the previous quarter between May and June. Only the increase in freight from Germany to France compared to 2020 is more impressive. Here, offer increased more than tenfold in the first month: 1312 percent in April, 731 percent in May and another 99 percent in June 2021.

Freight volumes in Spain exceed pre-crisis levels

Freight offered from Spain to the rest of Europe continued to increase in general. On the other hand, freight from Europe to Spain recorded only a slight increase compared to the first quarter of 2021. Compared to the pre-crisis period, May 2021 in particular stands out for its significant increase, especially in freight offers from Spain to Germany (+104%) and to France (+71%) compared to May 2019. The number of offers of cargo from Germany to Spain in May 2021 increased the most, by 125 percent compared to 2019. May is a strong month in Spain due to both food exports and imports: compared to 2019, the overall freight volume in May 2021 increased by 80 percent. Only freight offers with destination Romania decreased and fluctuated in the second quarter: April -53 percent, May -12 percent and June +73 percent.

The FreightTech company TIMOCOM has been using the transport barometer since 2009 to analyse the development of transport offers and demand across 46 European countries as recorded by the freight exchange, which is integrated into the Smart Logistics System. More than 135,000 users generate up to 800,000 international freight and vehicle space offers daily. The System helps over 45,000 TIMOCOM customers to meet their logistics goals smartly, safely and simply.