TIMOCOM Transport Barometer: Transport industry remains robust despite economic concerns and declining indicators.

Durchschnittlicher Frachtanteil in Europa.

The pressure on limited transport capacities remains high. The absolute number of freight offers in the spot market increased in the second quarter compared to both the previous year and the preceding quarter. Continued strong demand in the European transport market is expected over the summer months.

Transport demand in Europe: 23% more freight offers than in the same quarter last year

Following a moderate March, there was a significant increase in transport demand in April: there were 25% more freight offers across Europe compared to the same month last year, and in the seasonally strong May, it was 8% above the previous year. This was due in part to the short weeks caused by the Easter holiday and numerous public holidays, as well as the tight truck supply. Vehicle space offers were 5% below the previous year's value in the second quarter. However, June did not lose momentum either: in the TIMOCOM freight exchange, there were even 37% more freight offers recorded across all European countries than in the previous year. Over the entire quarter, there were a total of 23% more freight offers than in the previous year. The ratio of freight-to-vehicle space offers averaged around 80 to 20 in the second quarter.

Germany: freight offers 32% above last year

The continuously high demand for transport services led to a 32% increase in freight offers posted in Germany in the second quarter compared to the same quarter last year. This development can also be seen as a positive economic signal following the customs discussions and the uncertain global political conditions. The ratio of freight-to-vehicle space offerings rose to 88:12, also due to catch-up effects in export-related transport orders that were waiting for the increased tariffs.

Austria: 35% more freight offers

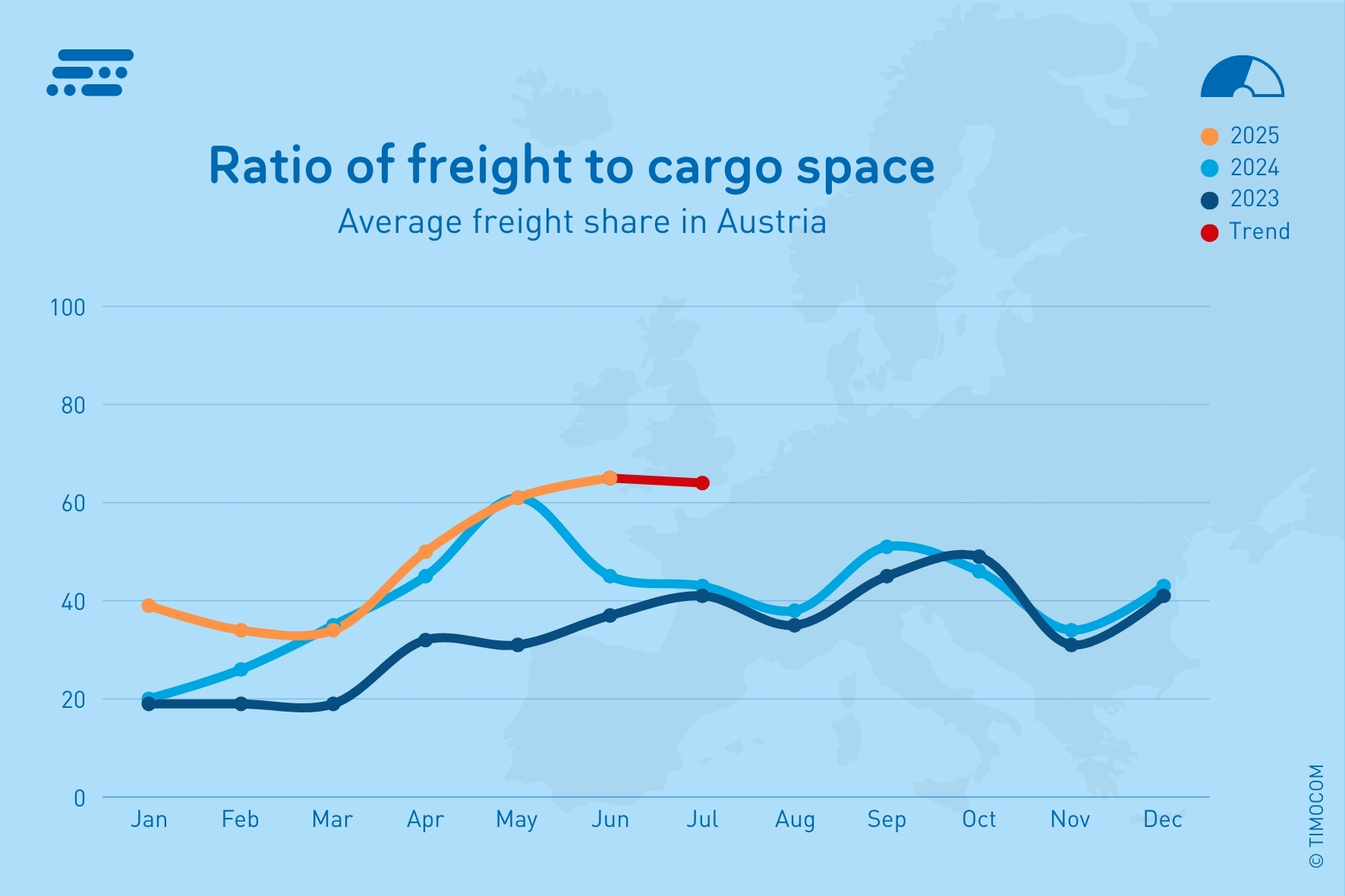

Freight offers within Austria were 35% higher in the second quarter compared to the previous year. In the months of April and June, there was a significant increase (+47%, +75%). From May onwards, a noticeable rise in the transport barometer for domestic Austrian transports was observed. The ratio of freight-to-vehicle space increased from a balanced ratio of 50:50 in April to June to 65:35.

Verhältnis von Fracht zu Laderaum in Österreich

Spot market prices: transport costs in Europe continue to rise

The freight offer prices specified by customers for standard transports, e.g. with a tautliner or curtainsider, remain at a correspondingly high level due to ongoing demand. On Europe-wide routes, they averaged between €1.45/km and €1.66/km weekly, while within Germany, they ranged from €1.68/km to €1.92/km. The highest values were recorded, among others, during the Easter weeks and the first week of May. Here, increased transport demand was spread over fewer working days due to the public holidays. This is reflected in the prices. The freight offer prices in Germany have increased by around 8% compared to the previous year over the entire period, while on Europe-wide routes, they have risen by about 5%.

Difference between offer prices and quotes

Furthermore, it is noticeable that the average quotes, i.e. the counter-offers from carriers, deviate more from the offer prices in Germany than the European average. While the difference in the 1st quarter was approximately 2 cents across Europe, the quotes as well as the freight offer prices in the 2nd quarter averaged around €1.61/km. In Germany, however, the quotes averaged around €1.97/km and the freight offer prices around €1.86/km: a difference of 11 cents. In the 1st quarter, it was only an 8 cent difference.

The offered freight rates on domestic Austrian routes in Q2 ranged between €1.93/km and €2.20/km, averaging around €2.08/km. Notably, the quotes averaged only €2.04/km, which is 4 cents lower. "The overall higher kilometre prices can be explained by the shorter total distances, where, in addition to the approach, the loading times account for a larger share than in long-distance routes. Additionally, there is a higher number of partial loads in domestic German and Austrian traffic," explains Gunnar Gburek. "Moreover, service providers who offer their customers GPS tracking and live shipment tracking as an additional service have good chances of negotiating higher transport prices."

Outlook: stable transport demand despite economic concerns

The economic expectations in the member states of the European Union according to the Economic Sentiment Indicator ( ESI ) show only 11 countries with positive prospects for 2025. These include Poland, Lithuania, Spain, Bulgaria, Cyprus, Croatia, Albania, Greece, Malta, Montenegro and Portugal. In all other states, a stagnating or even negative economic development is expected. Germany, Austria and France are in the bottom quartile, even well below the average of the Eurozone. Nevertheless, the demand for transport remains high, so no relaxation in the European transport market is expected during the summer months. “Although the freight share in the transport barometer typically falls below 80% until the end of August, this figure is expected to be reached again when the year-end business starts in September,” predicts Gunnar Gburek. “The development will also depend on the relief measures for consumers, their willingness to spend and the implementation of investment projects in Europe – both in the private and public sectors.”

More information in the current TIMOCOM Transport Barometer Report .