European Transport Market Q3 2025: The Great Shift

Transport demand increases by 25%, while vehicle space availability shifts to three Eastern European hubs

The European spot market shows a remarkable development in the third quarter of 2025: while transport demand is increasing, the vehicle space supply is stagnating and prices are rising only moderately. The background to this is that the increase in demand is primarily based on an economic recovery in Western Europe, while the available truck volume is increasingly shifting towards Eastern Europe.

Content of this quarterly report:

- Freight quotes

- Veehicle space offers

- Transport prices

- Germany's spot market

- Austria's spot market

- Outlook for Q4 2025

Western Europe fuels transport demand

The number of freight quotes continued to increase in the third quarter of 2025, rising by 25% compared to the same period last year. "There were two main drivers behind this: an economic recovery began in major South-West European markets, including France, Spain, and Italy. They offered significantly more freight on the spot market in the third quarter of 2025 than a year earlier," says Gunnar Gburek, Head of Business Affairs at TIMOCOM. "At the same time, we see strong growth markets in Eastern Europe, especially Poland, which are causing a decisive shift in capacities."

Freight Quotes - Q3 2025 vs. Q3 2024

Transport demand grows across Europe by +24.8%

Top 5 freight provider markets: Germany, France, Poland, Italy, Netherlands

Western Europe as a growth driver: 31.5%

Poland: +31% freight quotes after tripling the year before

Three capacity hubs are emerging in Eastern Europe

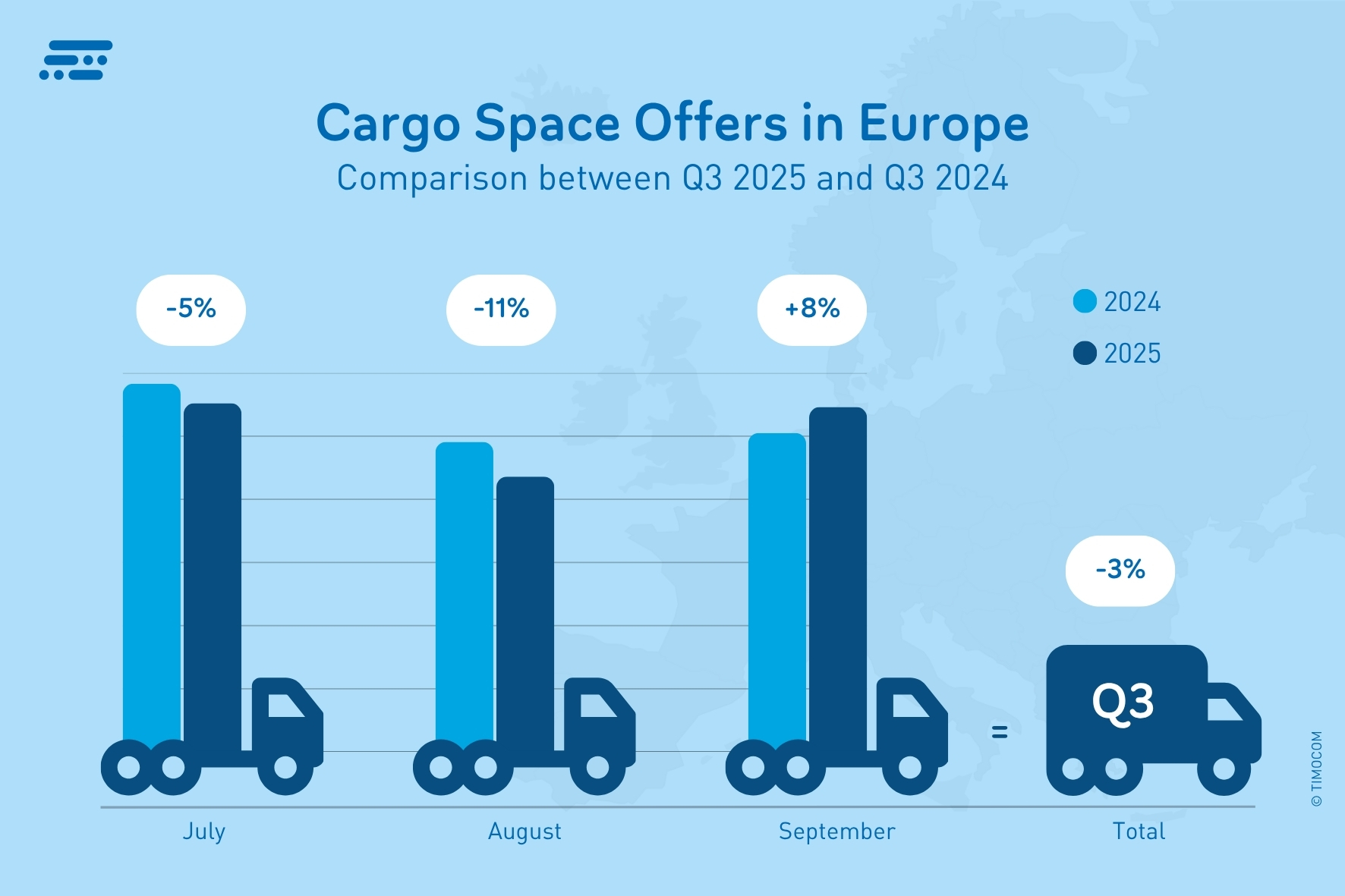

The truck vehicle space supply in European road freight transport remained at the previous year’s level in the third quarter. “The figure of -3% does not reflect the dramatic developments behind it at all,” explains Gunnar Gburek. “In certain markets, there were massive capacity collapses that were compensated for by other markets. We are observing a clear shift towards specific capacity centres.”

With a further growth surge of 35%, companies based in Lithuania took the lead among the three largest vehicle space markets in Q3 2025. This makes Lithuania not only the largest but also the most consistent provider of vehicle capacity in the European spot market. The second largest provider market was formed by Polish companies, although their vehicle space capacity supply recently declined, followed by companies from Romania, whose vehicle space offerings on the TIMOCOM freight exchange increased by 27% in the third quarter.

Gburek: "We have been observing significant movement among Polish and Romanian companies for the past two years. The number of vehicle space offers is very high, but they are no longer permanently available to the European market in full volume. The reason for this is likely that the economies of both countries are growing or recovering, which we can see from the increasing freight offers in both countries. For the haulage companies, this means they can deploy their own trucks and especially their drivers just as effectively in the local area, rather than having to send them all the way to Western Europe to earn money."

Vehicle space offers - Q3 2025 vs. Q3 2024

Top 5 vehicle space provider markets: Lithuania, Poland, Romania, Hungary, Austria

Large Eastern European providers with fluctuating trends: Poland: +24% (2023-2024) and -21% (2024-2025); Romania: -47% and +27%

Western European companies offer less vehicle space: Netherlands -20%, Austria -19%, Germany -15%

Balkans lose capacities to Romania: Bulgaria -21%, Slovenia -24%, Croatia -5%, Serbia +3%

Transport prices rise only moderately despite high demand

Transport prices in the European spot market have steadily increased over the past two years. In the third quarter of 2025, the average weekly prices from customers ranged between €1.43 and €1.67 per kilometre. During the same period, the prices from service providers were between €1.49 and €1.68. This means that the prices from freight providers and transport service providers in Europe were unusually close to each other recently.

"The price development is overall more moderate than the market situation would suggest," says Gunnar Gburek. "A significant reason is that the capacity shortage of Western European companies is being compensated by Eastern European competitors. And looking beyond the spot market, it can be said that the enormous price pressure on the transport market is leading to a strategic realignment of many freight forwarders. This includes both specialisation and a focus on higher-value segments in the West and on economically attractive markets in the East."

Freight routes between Germany and Western Europe strengthen

The German market recorded a significant freight increase of 31% in the third quarter compared to the same period last year. Notably, the share of domestic traffic has steadily declined in recent years and, for the first time in the third quarter of 2025, accounts for less than half of all German transport requests. Furthermore, the reduction in capacity continues. In the third quarter, German companies again posted 15% fewer vehicle space offers than in the same period last year.

The top growth ratios reflect the European developments: freight routes between Germany and its western neighbouring countries France, Belgium, and the Netherlands increased in significance in both directions. Additionally, Spain surprised as a strong recipient of German freight, and Poland emerged as a growing country of origin for freight.

Transport prices within Germany have increased slightly in recent months, although the price expectations of transport service providers consistently remained above those of the customers. Specifically, the prices from freight providers ranged between €1.56 and €1.90 per kilometre in the third quarter, while transport service providers quoted prices between €1.69 and €2.06 per kilometre.

Germany - Q3 2025 vs. Q3 2024

Freight quotes increased by 31%

Vehicle space offers decreased by 15%

Balanced domestic traffic and international routes

Prices have increased by an average of €0.10 per km.

Austria is an important transit market for European freight

The Austrian spot market shows a clear imbalance between demand and supply. The vehicle space offered by Austrian companies declined again in the third quarter. Although the decrease of 19% was less pronounced than in the previous year, it consolidated the established trend. At the same time, Austrian companies offered 23% more freight on the spot market in the third quarter than in the same quarter of the previous year. A large proportion of the freight was destined for international routes, with only 12% having their loading and unloading locations in Austria. “This pattern is typical for the Austrian market, which acts as a logistics hub between West and East as well as North and South,” says Gunnar Gburek. “The sharp decline in vehicle space offers from Austria, whose companies still rank among the top fleet providers, is likely being compensated by hauliers from other countries, primarily Eastern Europe.”

Austria - Q3 2025 vs. Q3 2024

Freight quotes increased by 23%

Vehicle space offers continuously decreased by 19%

International routes dominate with a share of 88%

Top routes with neighbouring countries Germany, Italy, Hungary, Czech Republic, Slovenia

Outlook: consumer revival intensifies pressure on the transport market

In the fourth quarter, the pressure on capacities in the spot market remains high, especially if public and private consumption increase as forecast. "If demand does not significantly decline even during the summer months, this is unlikely to change in the autumn days and before Christmas. Hauliers can look forward to the fourth quarter in the spot market with optimism, while customers must expect higher prices," says Gunnar Gburek. "However, despite a good order situation and rising transport prices, hardly any new capacities will come onto the market. The uncertainty regarding a stable upswing is still far too great to invest in vehicles and personnel."

More information soon, in our TIMOCOM Transport Barometer Report.